triple bottom stock good or bad

The only option which distinguishes a triple bottom from a head and shoulders bottom is the lack of a head between the two shoulders. I just got a bulk e-mail ad for yet another conference on so-called Triple Bottom Line Investing.

Trading Ist Ein Spiel Von Wahrscheinlichkeiten Ethereum Ein Ethereum Forextrading Ist Spiel Trading Vo Trading Quotes Probability Stock Market Quotes

A breakout will.

. Triple Bottom Line the bad idea that just wont die. Shakeouts can also occur at the. Unlike the bearish triple top pattern the triple bottom is a bullish one.

The Candlestick pattern shows the 3 major support levels of a stock from where it previously managed to give a bouce. Triple Bottom is helpful to identify bearish stocks stock that have been trading weak. Triple bottom pattern.

A valid triple bottom pattern produces a measured move so we can find a price target by calculating the vertical depth of the consolidation zone and then measuring an equal distance above. Wayne Norman and I wrote about the 3BL back in the April 2004 issue of Business Ethics Quarterly. This pattern is generally found within low trading ranges following downtrends and the break of resistance which confirms this pattern is what.

Start by writing down all actions. Stops An triple bottom fails and is not valid if prices break back below the lows before hitting its price target. In the cup-with-handle pattern the handle is where the shakeout occurs.

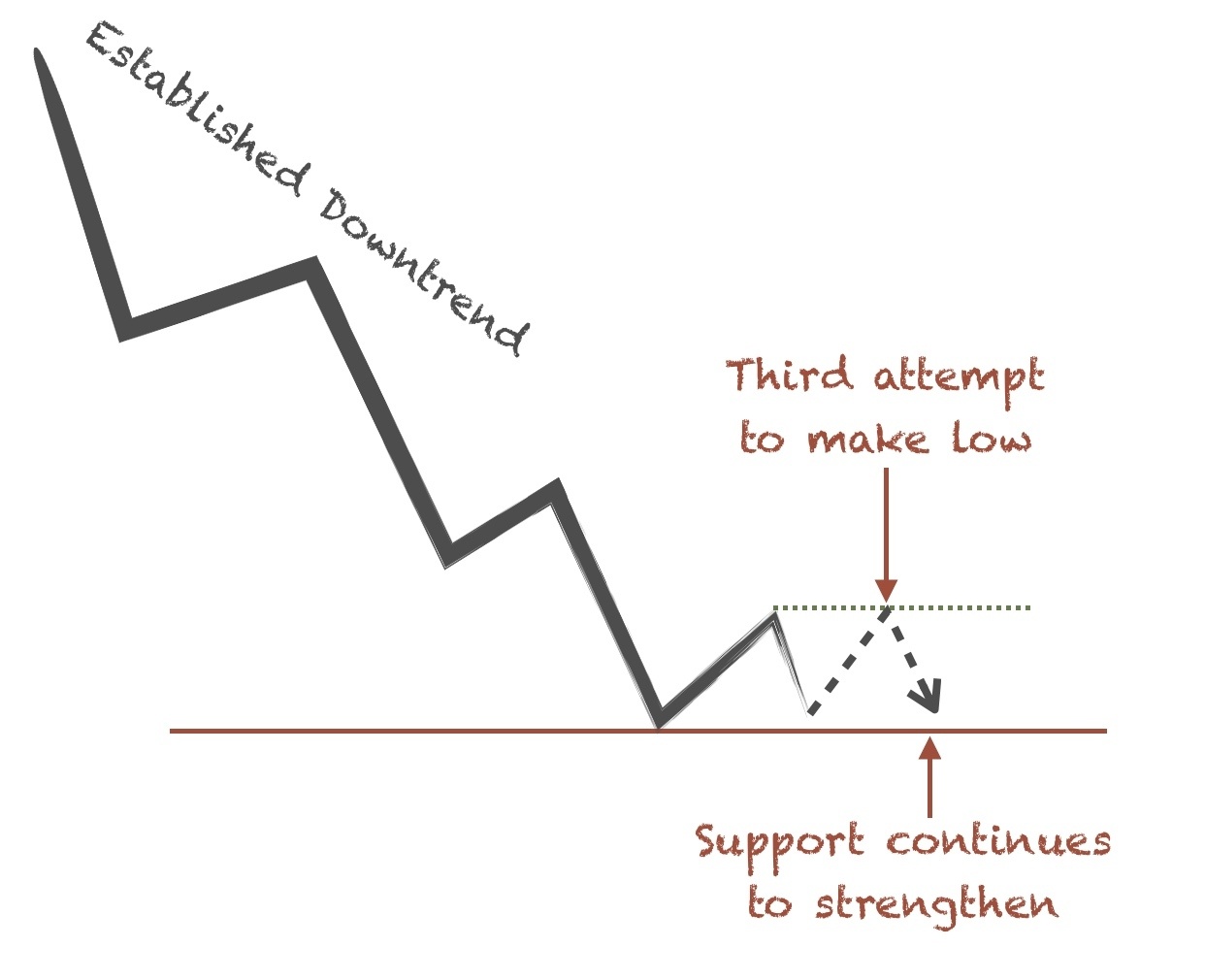

Of course you can flip the pattern upside. A triple bottom is a reversal pattern with bullish implications composed of three failed attempts at making new lows in the same area followed by a price move up through resistance. If prices are accepted back down into the bottoming zone once it has.

You can have either a triple top or a triple bottom pattern formation on a chart. Every good base should have a shakeout where the last remaining sellers exit the stock. Like that pattern the triple bottom is a reversal pattern.

Essentially the triple bottom pattern is a signal of a reversal of a sinking trend. The steeper the drop to the. They simply dont provide a good enough rewardrisk.

Just like the doubles in trading a triple top and a triple bottom dont happen at the same time. The triple bottom chart pattern is a classic price pattern for stock market trading. The triple bottom shows a downtrend in the procedure of becoming an uptrend.

Many double and triple topsbottoms arent worth trading. The triple bottom formation is formed in the downtrend. A triple top pattern reverses an uptrend whereas a triple bottom pattern reverses a downtrend.

This video and article gives you a 4-step process for accurately trading triple bottoms. This pattern is rare but a very reliable buy signal. Trades often consider this as a strong support level and expected re-bounce from the triple bottom level.

Entering a buy position when the price is just below a higher timeframe resistance level increases the chances of losses. As with any reversal pattern there should be an existing trend to reverse. DoubleTriple Bottoms and Tops.

That said these patterns can still be used for analytical insight. Triple Bottom Line Investing is just one more incarnation of the more general Triple Bottom Line or 3BL notion. The pattern is shaped like a W where a new low is established then a bounce higher.

The bounce peaks and falls again to re-test the first low range before bouncing again and breaking the peak of the prior bounce as the stock moves higher. The bottoms have roughly the same price level. This means that it will end up with an increase in value.

What you do is to make sure the higher timeframe price structure is favoring the triple bottom pattern. Double bottoms are trend reversal formations. In this pattern three consecutive bottoms are formed.

The First Step Gather Your Actions. When trading a triple bottom it is better to have the price structure supporting your trade. Its a trading pattern that can be used to enter a trend reversal.

The triple bottom is regarded to be a difference of the head and shoulders bottom. What Happens After A Triple Bottom Stock Pattern. Triple Top Triple Bottom Reversal Patterns Babies Metaphor.

It can also be used to exit a trade at the end of a trend. Take the framework of People Planet Profit and examine each one. By this definition we can say that the Triple Bottom Stock Pattern is Bullish because it tells traders to position for an upcoming upward trend.

Essentially a triple bottom pattern shows an asset that is trending downwards but fails to go through support three times. If the price breaks out of the bottom of the pattern it is probably trending lower for the next while.

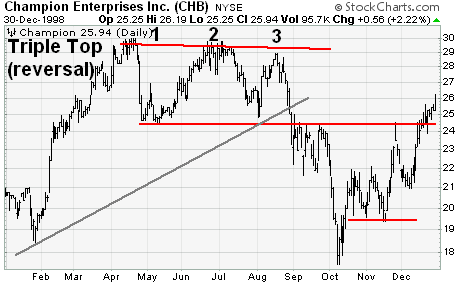

Triple Top Reversal Chartschool

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-01-4e2b46a5ae584c4d952333d64508e2fa.jpg)

Technical Analysis Triple Tops And Bottoms

Learn Easy Forex Trading The False Break Trading Strategy 2 Forex Trading Forex Trading Strategies

6 Really Bad Charismatic Doctrines We Should Retire High Paying Jobs Jobs Without A Degree Paying Jobs

Chart Patterns That Predict A Bullish Trend

Triple Top Reversal Chartschool

Where To Enter In 2022 Stock Trading Learning Trading Charts Financial Quotes

Save Some Pennies For Rainy Days Money Making System Investing Income Investing

/cupnhandle-b1a28683150e48578a72d53b6c18f7a2.jpg)

How To Trade The Cup And Handle Chart Pattern

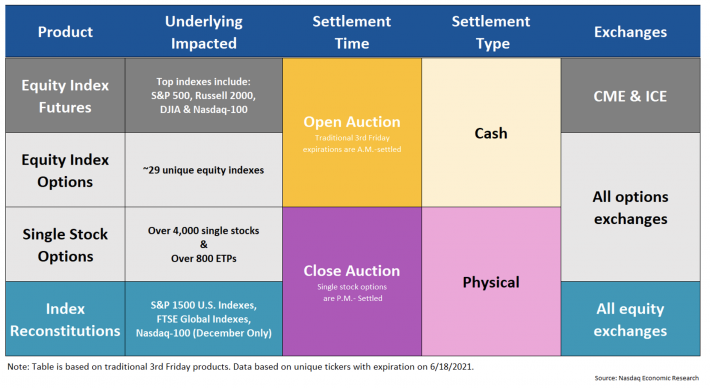

The Powerful Impact Of Triple Witching Nasdaq

Triple Bottom What The Chart Pattern Means And How To Make Money Using It Business Standard News

Corporate Social Responsibility Businessnewsdaily Com Corporate Social Responsibility Social Responsibility Social Cause

Triple Bottom What The Chart Pattern Means And How To Make Money Using It Business Standard News

3 Stocks That Could Triple Your Money The Motley Fool

Pre Owned Balenciaga Triple S Black Pink W In Black Pink White Modesens In 2022 Balenciaga Triple S Black Balenciaga Triple S Sneakers

Oil And Gas Barrels And Drums Symbol Stock Illustration Illustration Of Chemical Generation 18662932 Oil And Gas Oils Barrel

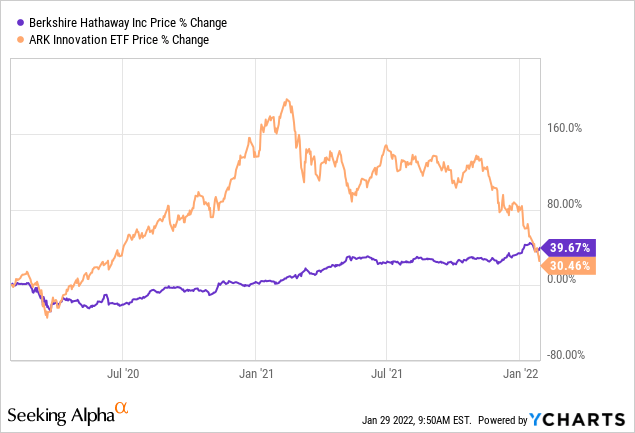

How Should Investors React To What Is Going On In The Stock Market Seeking Alpha

:max_bytes(150000):strip_icc()/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)